CHILDMINDER ACCOUNTANCY SERVICES

WRITTEN BY OUR IN HOUSE SPECIALIST, KELLY TURNER

We offer childminder accountancy services because we know childminders have their own unique tax rules which do not apply to any other business. I’m guessing if you’re looking after children all day, you like nothing more than researching tax rules in your spare time… um… er…. maybe not!!!

At EP Tax, we specialise in childminder accountancy services; so, whether you have one child temporarily or run a childminding business full time, we can help.

PST DON'T FORGET TO DOWNLOAD OUR FREE GUIDE

Why not sign up to receive our FREE EP Tax – Childminder Tax Factsheet, which explains the rules in non-accounting jargon. We know your time is precious, so we’ve tried to keep it short and sweet – just like the little people, you get to work with every day.

That’s not all. As a thank you for signing up to receive our FREE factsheet, we will also send you the following:

- How to claim your household costs

- A complete guide to running a sole trader business

- A list of the main allowable expenses for childminders

- A tax calculator to check you are saving enough tax

- An overview on whether you should register for PAYE or VAT

- A handy PDF booklet to complete your monthly income and expenditure

- Our guide to managing work-life balance and mental health

- Special discounts on childminder software, insurance and training

- + much, much more

THE RULES OF TAX AND ACCOUNTING FOR CHILDMINDERS

Becoming a childminder is a popular business option as it offers flexibility and the ability to work from home. However, running any business is daunting, and childminder businesses are no exception. Here we highlight the special tax rules for childminders and the most typical expenses you can claim.

Childminders are classed as trading from the moment you start to advertise or when you first take on a child. The rules state you need to register as self-employed within six months of the end of the tax year in which you start to trade. If you are not already registered for self-assessment, we can do this for you for no extra fee.

Childminders work in their own homes, often for most of the day. When most people ‘work from home’, it means a desk and a laptop or a small workshop – but not for childminders; their homes can get fully consumed by their business. In recognition of this, HMRC allows a 10% wear and tear allowance, allowing you to reduce your income by 10% to cover the cost of wear and tear on your household furniture and items. The allowance covers household items that are not used wholly and exclusively in childminding; therefore, they cannot be offset in full as a cost in your childminder accounts—for example, a new sofa, carpets, or a household TV. However, items you use just for your business can be fully offset.

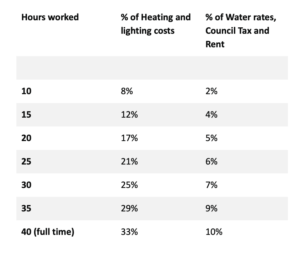

As childminders will incur higher household utility costs because of their business, HMRC has agreed to special rates that childminders can offset against their income.

This unique agreement allows childminders to deduct a % of their household bills based on the number of hours they work at home. The table below shows the amount which can be deducted based on the hours worked. For example, a childminder looking after a child full-time for 40 or more hours each week is entitled to claim the full-time proportion of expenses of 33% and 10%.

HMRC recognise that some of the expenses that childminders incur do not always come with a receipt – for example, attending coffee mornings or buying second-hand toys from Facebook. Therefore, childminders are allowed to claim any expenses of £10.00 or less without a valid receipt when calculating their taxable profits. However, please note that if you purchase several smaller items at one time and the total cost is £10 or more, you will still need a receipt.

Reasonable estimates for the costs of food and drink provided for the children being cared for are acceptable, and receipts are not required.

If you use your car for your childminding business, keep a record of the number of miles

travelled, as you can claim 45p per mile for any business-related journeys. Alternatively, you can claim a % of the actual costs of running your vehicle (unless you use it solely for the childminding business). We review the best method of claiming travel expenses with all our childminding clients.

You can claim any expenses you incurred before starting your childminding business – add them into the first month you started your business.

Here is our list of typical start-up expenses:

- Public liability insurance

- Application/registration fee

- Fees or charges for house inspections

- Additional smoke detectors

- Stair gates

- First aid box and its contents

- Accident book

- Membership fees to a childminding organisation and records book

- Contracts and receipt books for parents

If you receive a government grant to start up, this income is not taxable; however, you can’t deduct expenses for items you purchased with the grant money.

- Toys, excursions, books, nappies, labelled uniforms, and safety equipment

- Stationery, insurance, Ofsted fees, membership fees or professional subscriptions

- Mortgage interest payments can be claimed in proportion to business usage – this is something you should seek professional advice on before claiming on your tax return due to the implications it may have when you sell your home

- TV & Licence can only be claimed if used exclusively for childminding business. If additional TV packages are purchased, the additional cost can be claimed

- Phone and Broadband – a reasonable % can be claimed.

OUR CHILDMINDER ACCOUNTANCY SERVICES ARE HERE TO HELP

Tax Returns and accounts can be stressful for anyone. But for childminders who are busy looking after little ones all day, it can become overwhelming.

At EP Tax, we specialise in childminder accountancy services. We make sure that you pay as little tax as possible whilst staying within the rules.

If you would like to book a 15-minute phone call with one of our friendly team, please use the button below to book a chat.