EXCITING STUFF ABOUT PROPERTY INCOME TAX

WRITTEN BY OUR IN HOUSE SPECIALIST

Ok, so maybe we are pushing it by putting the words ‘exciting’ and ‘Property Income Tax’ into the same sentence. But we find it exciting and you’ll be pleased to know that here at EP Tax, we do not do boring… in fact, you may even enjoy reading our page all about property income tax.

EP Tax is nestled in the heart of Ludgershall, specialising in accounts and tax returns for property investors; whether you have one property or a portfolio, have joint property, or whether you trade via a Limited Company, we are here to help! On this page, we have even listed the main allowable expenses you can claim against your property income tax.

Owning and renting out property is a popular investment for many individuals and companies. On this page, you will find information on the main things to consider when receiving income from property – further details can also be found in our ‘Property Income Tax Guide’ which can be downloaded below.

EP TAX - TAKING THE BORING OUT OF ACCOUNTING

EP Tax has been established since 2007. We are a small, friendly team with an enthusiastic and strong commitment to helping new and existing businesses within Tidworth, Andover, surrounding areas and across the UK. And as an accountancy business, we pride ourselves in our accounting packages being provided to you with a customised approach through a streamlined service.

We know that what we do for most people is about as enjoyable as sitting through a child’s Year 1 recorder concert… but, we are not most people. We are in the strange minority who actually enjoy completing tax returns… and we’re not just saying that so you’ll pay us to do yours.

OUR PROPERTY INCOME TAX GUIDE

Our property income guide covers:

- The basics on how property income is taxed

- Property allowance

- Mortgage interest relief

- Capital VS revenue expenditure

- Income splitting

- How to keep good records

- A list of the main allowable expenses

- Plus much, much more

NOW LET'S GET ONTO THE STUFF YOU WANTED TO READ ABOUT...

Let’s start at the beginning – How property income is taxed

As a landlord, you will pay income tax on any profit you make from rental properties that you own. The profit is calculated by deducting certain expenses and allowances from your rental income; the rules on what you can and cannot claim against your income are specific to property businesses.

Nobody wants to pay more tax than they need to, so we guide our clients through the do’s and don’ts and the various ways to reduce your tax liability, whilst obviously not breaking the rules (whilst you want to pay as little as possible, you won’t want to get into trouble with HMRC either).

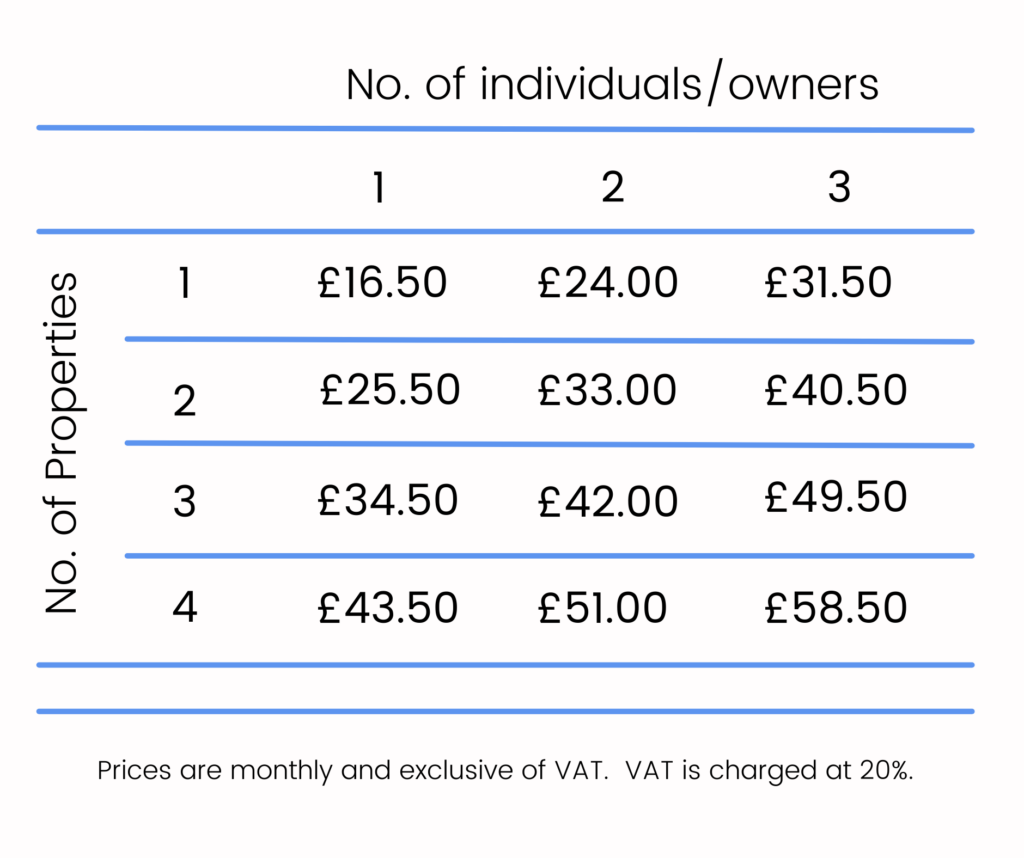

OUR PRICES MIGHT SURPRISE YOU

We offer a fixed price service with NO HIDDEN FEES. We told you at the start we’re not like most other accountants.

Here are our prices…

WHO CAN WE HELP?

Whether you are local to us in Wiltshire or are based in the far corners of the UK, we can help – all thanks to modern technology. Whilst we love meeting our clients face to face at our office in Ludgershall (near Andover and Tidworth) we have many clients with whom we communicate via Microsoft Teams, email and our secure client portal.

Remember at the beginning when we said we'd list the allowable expenses for you? Well, look no further.

- Management fees

- Letting agent fees

- Council tax, electricity, gas and other utilities that are not paid by the tenant

- Mileage to the property (or any journey made wholly and exclusively in relation to your property investment) – at 45p per mile (keep a log of your mileage)

- Repairs and renewals

- Financing costs (interest, loan arrangement fees etc) – just make sure you apply the new mortgage interest relief rules

- Training – so long as you are extending a current skill and not obtaining a new one

- Legal fees

- Cleaning and gardening

- Accountancy and other professional fees